top of page

Industrial Grade Accountability: Lessons from the Behavioral Finance Classroom

Behavioral economists such as Richard Thaler and Daniel Kahneman identified a concept both intuitive and profound: individuals frequently prioritize immediate gratification over long-term benefit. Behavioral economists suggest our default wiring overweighs the present compared to future benefits. This neurological reality suggests humans struggle to sustain the discipline required for a prosperous tomorrow (Kahneman, 2011). For instance, enjoying a fun dinner with friends act

Jeff Hulett

Jan 113 min read

The Great AI Pivot: Why Your Leap of Faith is the Key to a Brighter Future

History is not merely a collection of dates and names; it is a series of "pivots." These are the moments when the tectonic plates of human productivity shift, forever changing how we live, work, and relate to one another. From the steam engine to the internet, every great economic leap has required something deeply human, yet frequently resisted: a leap of faith. Today, as Artificial Intelligence weaves its way into the fabric of our professional lives, we stand at the thresh

Jeff Hulett

Jan 75 min read

Why New Year’s Resolutions Fail (Try this instead)

I’ll let you in on a secret: I REALLY don’t like New Year’s resolutions. 🙅♂️ Most fail because we're hard-wired for "Survival Today," not 100% perfection. In this video, I explain how to use the 80/20 Rule (The Pareto Principle) to ensure compliance and avoid burnout. Stop chasing perfection and start mastering your tradeoffs. Take control of your 2026 goals: 📖 Get the book: Making Choices, Making Money #NewYearNewMe #2026Goals #Resolutions #8020Rule #PersonalFinan

Jeff Hulett

Jan 21 min read

Adaptability and capturing the winds of luck

Today, I will show you how to put luck to work for you. Luck has an element of pursuit energy that goes beyond preparation and opportunity. Plus, we need to be adaptable in our opportunity pursuits. In the last vidcast, I introduced 2 friends to help us with adaptability. Those friends are Stanford entrepreneurship program leader Tina Seelig and Venture Capitalist Natalie Fratto. I will be integrating some of their amazing thinking to help explain my success framewor

Jeff Hulett

Jan 22 min read

From Debt to Financial Freedom: Lindsey Scott Shares Her Journey

On this episode of Personal Finance Reimagined , we had the pleasure of interviewing Lindsey Scott, a certified financial coach whose incredible story is an inspiration for anyone looking to take control of their financial future. Lindsey and her husband started their journey facing a daunting $64,000 in debt. Through strategic decisions, disciplined habits, and a clear purpose, they paid off every penny in just 18 months—an achievement that has since become the foundation of

Jeff Hulett

Jan 22 min read

The Neurological Blueprint of Wealth: Harnessing Our Brain's Design for Financial Success

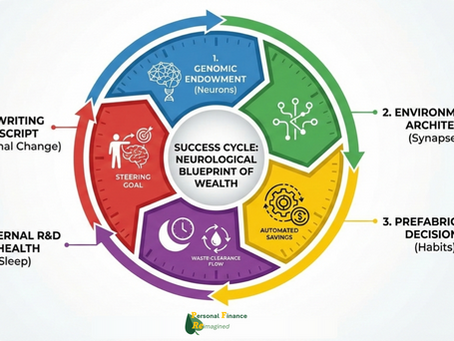

Personal Finance Reimagined (PFR) maintains a mission empowering individuals to cultivate a consistent, repeatable decision-making process for a lifetime of wealth. We work with students, entrepreneurs, and all those interested in this success path. This pursuit extends beyond spreadsheets; it requires understanding the biological engine driving those decisions. While our brains are dynamic products of evolution and environment, they are not static. The core of this framework

Jeff Hulett

Jan 27 min read

Wayne Gretzky and creative-divergent thinking

Connect the dots between “what is” in the present and “that which may be" in the future.

Jeff Hulett

Jan 25 min read

Luck is where preparation and opportunity meet - building the success mindset

Luck is where preparation and opportunity meet - building the success mindset In the YouTube video "Luck is Where Preparation and Opportunity Meet: Building the Success Mindset," Jeff Hulett delves into the timeless wisdom of Seneca's aphorism and expands it into a modern framework for success. Drawing on his expertise as a career banker, behavioral economist, and educator, Hulett emphasizes that success is not just a product of preparation and opportunity but also adaptabil

Jeff Hulett

Jan 22 min read

Smart Machines, Smarter Humans: How to Build a Winning AI Partnership

Generative AI makes mistakes. While many observers use the term hallucination to justify avoidance, this hesitation results in missing a massive opportunity. The technology thrives on a partnership where the tool remains imperfect but proves incredibly useful. Adopting a proactive mindset enables users to extract maximum value while navigating inherent limitations. Figuring out how to increase machine precision through your own accuracy ultimately makes you smarter and faste

Jeff Hulett

Dec 21, 20254 min read

Hidden in Plain Sight: Building the Bedrock for First-Generation Financial Agency

In the American cultural narrative, the term "first-generation" is often regarded as a niche category or a specific demographic box. At PFR, we see it differently. The challenges facing these students often remain hidden in plain sight. These obstacles rarely stem from a lack of talent or ambition; instead, they reflect a lack of exposure to the "family business" of higher education and the complex financial systems supporting it. According to U.S. Census Bureau data released

Jeff Hulett

Dec 20, 20255 min read

The Decision Challenge: Why Financial Choices Feel Hard at Every Stage of Life

At some point, almost everyone confronts a financial decision that feels heavier than it should. Sometimes it arrives early, with a first job and a benefits portal full of unfamiliar investment options. Other times it shows up years later: a year-end email asking you to revisit your elections, a promotion that shifts your tax bracket, a divorce that forces new priorities, or a market downturn that makes risk suddenly feel personal. The circumstances change, but the experience

Chris Dias

Dec 19, 20256 min read

The Serendipity Investment: Why Startup Founders Must Invest In Something They Can't See

In the high-stakes ecosystem of entrepreneurship, focusing on the "seen" is essential. Tracking customer acquisition costs, refining product features, and navigating tax complexities must consume the majority of a founder’s time. This work grounds the business and powers the daily engine. However, a dangerous trap exists in giving the "seen" 100% of your focus. While the "seen" maintains the current trajectory, the most transformative breakthroughs—changing a company’s trajec

Jeff Hulett

Dec 18, 20258 min read

Appreciations and Opportunities: PFR's 2025 Annual Letter

Dear PFR Advisory Board Members and Supporters, First, I have really appreciated your amazing support this year. I value each of our touch points and I look forward to more in the future. 2025 was a really good year for Personal Finance Reimagined (PFR). Lots of market validation and delivery refinement. Our messaging gets better all the time and the client feedback has been positive and provides growth opportunities. The bottom line: PFR IS WORKING , our DecisionFIRST, finan

Jeff Hulett

Dec 17, 20253 min read

The Freedom Fund: The PFR Path to Mastering Risk and Money

Learning to take strategic risks is the essence of financial freedom. It is important for both startup founders and for achieving financial success in your personal life. The concept of De-Moral Hazarding (DMH) is one of the most powerful ideas in personal finance, yet its implementation is often the greatest challenge. At its core, DMH suggests when you choose to self-insure against manageable losses—meaning you build personal savings to cover the risk—you change your beha

Jeff Hulett

Dec 14, 20257 min read

The Judgment Paradox: Transforming Biological Instinct into Financial Clarity

Next is a short, interesting story about 1) why we are naturally bad decision-makers and then 2) how to turn that frown upside down and use the same nature to your massive advantage! We will walk through some ancient history and how our brain operates. We conclude the story with you as the hero. Showing how you can make great decisions. If you turn to the great wisdom traditions of the world—particularly Stoicism or Buddhism—you will find a consistent warning: Judgment is

Jeff Hulett

Dec 8, 20254 min read

Next Gen Financial Literacy: Why Addressing the Decision Deficit is the Key to Modern Prosperity

I spent decades in the high-stakes banking world, watching how institutional systems often win at the expense of the individual. I eventually realized how millions of Americans are held back not by a lack of money, but by a "Decision Deficit"—a gap between how banks think and how people choose. I chose to leave the secure banking world behind to found Personal Finance Reimagined (PFR) because I knew I had to turn the tools of the banking industry into a shield for the people.

Jeff Hulett

Dec 7, 20254 min read

The $1 Habit: Why Living Below Your Means Is the Single Greatest Financial Skill

For many students and young adults, the pursuit of long-term wealth seems complicated, requiring insider knowledge of stocks or complex systems. In reality, the foundation of riches is not found in complicated strategies or high incomes, but in simple behavioral discipline: the habit of consistently living below your means. The core of financial success is not about deprivation; it's about optimizing your resources to create a surplus. This surplus is the most powerful tool i

Jeff Hulett

Dec 6, 20252 min read

Stop Overpaying for College: Mike Munger on Transaction Costs, ROI & The Triple T Framework

I recently had the pleasure of sitting down with one of my favorite thinkers, Duke Economist and Political Science Professor Mike Munger , to dissect the "super complex" challenge of college decision-making. As President of Personal Finance Reimagined (PFR), I know this choice is massive. College is more expensive than ever, yet there are more lower-cost alternatives—from community colleges to taking a gap year—that deserve serious consideration. The question isn't just where

Jeff Hulett

Dec 4, 20251 min read

Science Says You Have No Free Will. Here's Why You Must Ignore It.

As President of PFR and a Personal Finance Professor at JMU, I've spent years observing one persistent barrier to success: fatalism. The belief that our outcomes—financial, professional, or personal—are fixed by forces beyond our control. This idea, rooted in the philosophy of Determinism, finds powerful support in modern science, particularly neuroscience. Scientists like Robert Sapolsky argue that every choice is merely the inevitable output of our determined neurobiology.

Jeff Hulett

Dec 2, 20251 min read

The Accuracy Paradox: Why Precision is Not Enough for Success with GenAI

We are entering a new economic age, defined not by capital or labor, but by partnership with artificial intelligence. Our reliance on these powerful collaborators benefits from taking inventory of classic economic principles, particularly the division of labor, and fine-tuning our approach. If we confuse the machine's ability to execute consistently (Precision) with its capacity for goal setting (Accuracy), we set ourselves up for failure. Mastering this partnership requires

Jeff Hulett

Nov 30, 202512 min read

bottom of page